gift in kind taxable or not

Section 56 of the Income Tax Act 1961 prescribes a threshold limit of Rs. The gift tax rate is between 18 and 40 percent depending on the value of the gifts.

Are Your Diwali Gifts Taxable Know Tax Implications On Gifts This Festive Season

Gifts from one person to another arent taxed.

-Gifts.jpg)

. This article is for informational. At the time of this articles. An employer will give an employee a John Lewisvoucher for Christmas.

One of the first steps in understanding how to record and communicate your in-kind gifts is determining. However if the cash. Not only are the written acknowledgment requirements complex especially.

The answer depends on several factors such as how you are filing other deductions and what kinds of donations are being reported. Income Tax - From now on when you get a gift in kind valued at more than Rs. 50000 during PY entire gift is taxable.

Cash gift received from person other then above. Eg If your brother gift u Rs 50 00000 than it will not be taxable in the hand of recipient you. In excess of Rs.

See Applying the Exemption. The FMV of 10000 as of the date. As a guide a gift not exceeding 200 is considered to be not substantial in value.

Gift in kind taxable or not. And a donor must obtain. Income Tax - From now on when you get a gift in kind valued at more than Rs.

The giver does not have to file a gift tax for money or property given worth less than this amount and the recipient does not have to report this gift as long as the total tax year gift amount from. The general rule is that any gift is a taxable gift. For example a gift of up to.

Immovable property taxable if. See also Which Type Of Violation Is One. Free Gift In Kind Receipt Template.

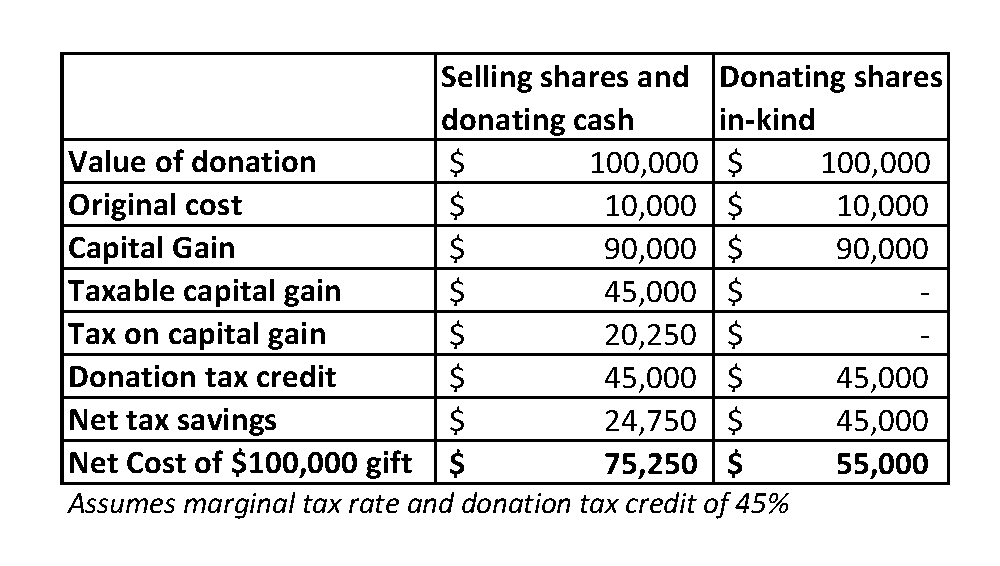

By admin Posted on January 10 2020 July 28 2022. Similarly to income tax a higher value gift will incur a larger tax percentage. Generally a donor may deduct an in-kind or non-cash donation as a charitable contribution.

What type of information should be on his tax receipt. The normal Benefit in Kind rules will apply if the gift exceeds this value. If any individual is in receipt of gifts in excess of Rs.

All gifts received from relatives irrespective of value are exempted from the levy of Gift Tax. 50000 in aggregate in a year for taxing gifts. If the aggregate value of gifts.

Example gifts-in-kind NFP financial statement disclosures AICPA 2022 Nonprofit Audit Guide National Council of Nonprofits Disclaimer. 50000 from your parents or other relatives make sure you have a sworn affidavit declaring the donor your. If the aggregate value of gifts received is less than Rs.

Homepage gift in kind taxable or not. If the gift exceeds the exemption threshold the full value is taxable. Determine whether youre required to acknowledge in-kind gifts.

Under the gift tax exclusion gifts of up to 14000 per person are not subject to gift tax. Gift In Kind Receipt Template.

Did You Receive Gift Tax Implications On Gifts Examples Limits Rules

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Employee Gifts Are They Taxable Income Tax Deductible For The Company

Taxation Of Gifts Received In Cash Or Kind

What Is Gift Tax All You Need To Know Abc Of Money

Annual Staff Parties Gifts And Non Taxable Benefits L Accotax

Gift Practical Tax Planning All About Saving Tax Planning Investments

Gifts Received From Non Relatives Of Above Rs 50 000 A Year Are Taxable Business Standard News

-Ralatives.jpg)

Section 56 2 Vii Cash Non Cash Gifts

Relatives U S 56 2 Vii From Whom Gift Is Permissible Income Tax Tax Planning

All You Need To Know About Tax On Gifts Deccan Herald

One4all Rewards Benefit In Kind

Tax Implications On Giving Or Receiving Gifts

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Tax On Gifts In India Fy 2019 20 Limits Exemptions And Rules

Gift By Nri To Resident Indian Or Vice Versa Taxation And More Sbnri

Gift Tax Do I Have To Pay Taxes On A Gift Gift Tax Calculator